Btcshorts

When it comes to navigating the world of cryptocurrency trading, understanding the concept of "Btcshorts" is crucial for success. Whether you're a seasoned trader or just starting out, these three articles will provide valuable insights and strategies to help you effectively manage Btcshorts and make informed decisions in the market.

When it comes to navigating the world of cryptocurrency trading, understanding the concept of "Btcshorts" is crucial for success. Whether you're a seasoned trader or just starting out, these three articles will provide valuable insights and strategies to help you effectively manage Btcshorts and make informed decisions in the market.

Strategies for Managing Btcshorts in a Volatile Market

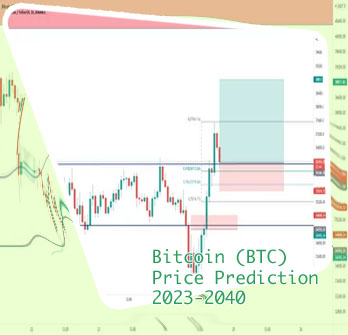

As volatility continues to be a defining characteristic of the cryptocurrency market, managing short positions in Bitcoin (BTC) can be a challenging task for investors. In order to navigate these turbulent waters, it is crucial to employ effective strategies that can help mitigate risk and maximize potential returns.

One key strategy for managing BTC shorts in a volatile market is to set clear stop-loss orders to limit potential losses. By establishing predetermined price levels at which to exit a short position, investors can protect themselves from significant downturns in the market. Additionally, utilizing trailing stop-loss orders can help capitalize on gains while still protecting against sudden reversals.

Another important tactic is to diversify short positions across multiple assets in order to spread risk. This can help minimize exposure to any single asset's price movements and reduce the impact of volatility on overall portfolio performance. Additionally, staying informed about market trends and news can provide valuable insights for making informed decisions about when to enter or exit short positions.

Feedback on these strategies from a resident of London, England, named Oliver Davies, a seasoned cryptocurrency investor, highlights the importance of staying disciplined and sticking to a well-defined trading plan. He emphasizes the need to remain patient and not let emotions dictate trading decisions, especially in a highly volatile market like cryptocurrencies. By following these strategies and maintaining a

The Risks and Rewards of Shorting Bitcoin: What You Need to Know

Shorting Bitcoin can be a risky but potentially rewarding investment strategy for traders looking to profit from the volatile nature of the cryptocurrency market. Shorting involves borrowing Bitcoin from a broker and selling it at the current market price, with the expectation of buying it back at a lower price in the future to repay the loan.

One of the main risks of shorting Bitcoin is the potential for significant losses if the price of Bitcoin rises instead of falls. Since there is no limit to how high the price of Bitcoin can go, short sellers could face unlimited losses if they are forced to buy back Bitcoin at a higher price than they sold it for. Additionally, shorting Bitcoin can be more expensive than buying and holding the cryptocurrency, as traders must pay interest on the borrowed Bitcoin.

Despite the risks involved, shorting Bitcoin can also offer substantial rewards for traders who are able to accurately predict market trends. By taking advantage of downward price movements, short sellers can profit from falling prices and potentially generate significant returns on their investment.

In conclusion, shorting Bitcoin can be a high-risk, high-reward investment strategy that requires careful consideration and risk management. Traders should be aware of the potential pitfalls of shorting Bitcoin, but also the opportunities for profit that it can offer in the volatile cryptocurrency market.

Maximizing Profits with Btcshorts: Tips from Experienced Traders

In the fast-paced world of cryptocurrency trading, experienced traders understand the importance of maximizing profits through strategic moves. With the rise of Bitcoin shorts, traders are finding new opportunities to capitalize on market fluctuations and increase their earnings.

By leveraging the insights and tips shared by seasoned traders, beginners can learn valuable strategies to navigate the volatile crypto market. From setting stop-loss orders to diversifying portfolios, these tips can help traders minimize risks and optimize their profit potential.

One key piece of advice from experienced traders is to closely monitor market trends and news updates to stay ahead of the curve. By staying informed and adapting to changing market conditions, traders can make informed decisions that lead to higher profits. Additionally, utilizing technical analysis tools and chart patterns can help traders identify potential entry and exit points for their trades.

Overall, "Maximizing Profits with Btcshorts: Tips from Experienced Traders" provides valuable insights for traders looking to enhance their profitability in the world of cryptocurrency trading. By incorporating these tips into their trading strategy, traders can increase their chances of success and achieve their financial goals in the competitive crypto market.